calculator home loan mortgage rate comparison guide for borrowers

Why a calculator matters

A good tool turns a headline rate into real dollars, showing monthly payments, total interest, and how points or extra principal change the timeline. It helps you weigh fixed versus adjustable terms, 15-year speed against 30-year flexibility, and whether a refinance break-even makes sense.

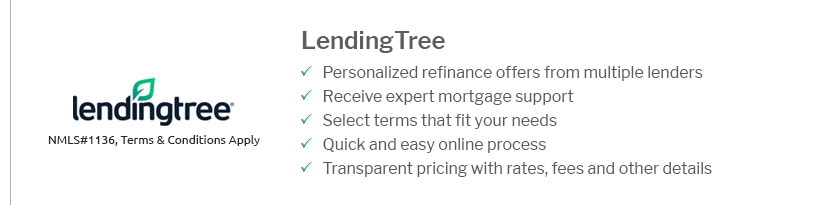

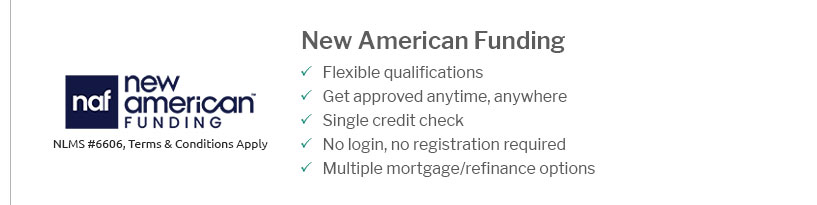

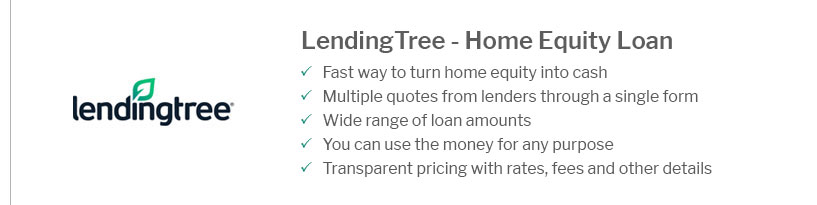

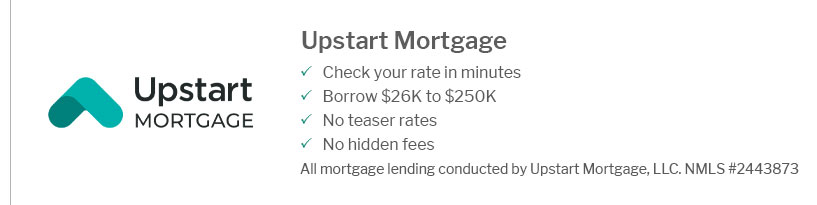

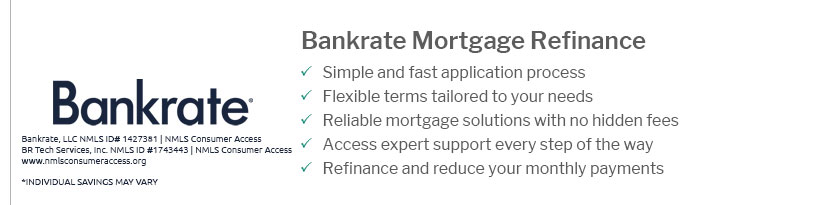

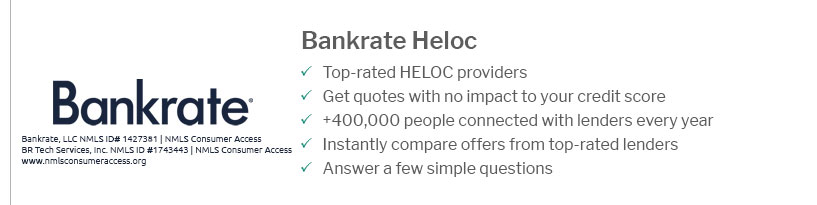

Comparing popular options

Most bank portals are quick and clean, while credit union widgets can be conservative but transparent about fees. Independent fintech calculators often add sliders, amortization charts, and prepayment toggles. Government or housing agency tools tend to be plain yet reliable, great for stress-testing affordability.

- Bank sites: instant quotes, frequent rate updates, easy prequalification.

- Credit unions: member-focused assumptions and lower baseline margins.

- Fintech apps: scenario modeling, payoff goals, and shareable results.

- Agency tools: neutral benchmarks for APR and income ratios.

- Spreadsheet templates: maximum control for custom cases.

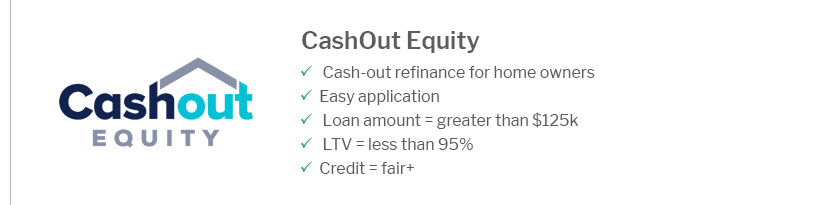

Getting accurate results

Enter down payment, taxes, insurance, and private mortgage insurance; include closing costs, and compare APR across lenders. Save scenarios so you can revisit when rates move.